S-1/A: General form of registration statement for all companies including face-amount certificate companies

Published on April 19, 2021

Table of Contents

As filed with the Securities and Exchange Commission on April 19, 2021.

Registration No. 333-254738

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 2

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

UiPath, Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 7372 | 47-4333187 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

90 Park Ave, 20th Floor

New York, New York 10016

(844) 432-0455

(Address, including zip code, and telephone number, including area code, of Registrants principal executive offices)

Daniel Dines

Chief Executive Officer, Co-Founder, and Chairman

UiPath, Inc.

90 Park Ave, 20th Floor

New York, New York 10016

(844) 432-0455

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Nicole Brookshire Eric Jensen Matthew Dubofsky Owen Williams Cooley LLP 55 Hudson Yards New York, New York 10001 (212) 479-6000 |

Brad Brubaker Chief Legal Officer UiPath, Inc. 90 Park Ave, 20th Floor New York, New York 10016 (844) 432-0455 |

Alan F. Denenberg Byron B. Rooney Yasin Keshvargar Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 (212) 450-4000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of large accelerated filer, accelerated filer, smaller reporting company and emerging growth company in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|||

| Non-accelerated filer |

☒ |

Smaller reporting company |

☐ |

|||

| Emerging growth company |

☒ |

|||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

|

||||||||

| Title of each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price Per Share(2) |

Proposed Maximum Price(1)(2) |

Amount of Registration Fee(3) |

||||

| Class A common stock, par value $0.00001 per share |

27,474,393 |

$54.00 | $1,483,617,222 | $161,863 | ||||

|

|

||||||||

|

|

||||||||

| (1) | Includes 3,583,616 additional shares that the underwriters have the option to purchase. |

| (2) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(a) of the Securities Act of 1933, as amended. Includes the aggregate offering price of additional shares that the underwriters have the option to purchase. |

| (3) | The registrant previously paid a registration fee of $133,508 in connection with prior filings of this Registration Statement. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant will file a further amendment which specifically states that this Registration Statement will thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement will become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. PROSPECTUS (Subject to Completion) Issued April 19, 2021 23,890,777 Shares CLASS A COMMON STOCK This is an initial public offering of shares of Class A common stock of UiPath, Inc. We are offering 9,416,384 shares of our Class A common stock and the selling stockholders identified in this prospectus are offering an additional 14,474,393 shares of our Class A common stock. We will not receive any proceeds from the sale of shares by the selling stockholders. Prior to this offering, there has been no public market for our Class A common stock. It is currently estimated that the initial public offering price will be between $52.00 and $54.00 per share. Following this offering, we will have two classes of common stock: Class A common stock and Class B common stock. The rights of the holders of Class A common stock and Class B common stock are identical, except with respect to voting, conversion, and transfer rights. Each share of Class A common stock is entitled to one vote. Each share of Class B common stock is entitled to 35 votes and is convertible at any time into one share of Class A common stock. In addition, all shares of Class B common stock will automatically convert into shares of Class A common stock in certain circumstances, including following the date that the number of shares of Class B common stock outstanding is less than 20% of the number of shares of Class B common stock outstanding immediately prior to the completion of this offering. See the section titled "Description of Capital Stock-Class A Common Stock and Class B Common Stock." Our Chief Executive Officer, Co-Founder, and Chairman and his controlled entities hold 100% of our outstanding Class B common stock and will hold approximately 88.1% of the voting power of our outstanding capital stock immediately following this offering, assuming no exercise of the underwriters' option to purchase additional shares of Class A common stock to cover over-allotments. We have applied to list our Class A common stock on the New York Stock Exchange under the symbol "PATH." We are an "emerging growth company" as defined under the federal securities laws and, as such, we have elected to comply with certain reduced reporting requirements for this prospectus and may elect to do so in future filings. Investing in our Class A common stock involves risks. See "Risk Factors" beginning on page 19. PRICE $ A SHARE Per Share Total Initial public offering price ................................ $ $ Underwriting discounts and commissions(1) .................. $ $ Proceeds, before expenses, to UiPath, Inc. ................... $ $ Proceeds, before expenses, to the selling stockholders .......... $ $ (1) See "Underwriting" for additional information regarding compensation payable to the underwriters. At our request, Morgan Stanley & Co. LLC has reserved up to 2.0% of the shares of Class A common stock offered by this prospectus for sale at the initial public offering price through a directed share program to certain individuals identified by our officers and directors who express an interest in purchasing Class A common stock in this offering. For additional information, see the section titled "Underwriting." We have granted the underwriters the option to purchase up to an additional 3,583,616 shares of Class A common stock from us on the same terms as set forth above to cover over-allotments, if any. Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense. The underwriters expect to deliver the shares of Class A common stock to purchasers on , 2021. Prospectus dated , 2021. Morgan Stanley J.P. Morgan BofA Securities Credit Suisse Barclays Wells Fargo Securities SMBC Nikko BMO Capital Markets Mizuho Securities KeyBanc Capital Markets TD Securities Truist Securities Cowen Evercore ISI Macquarie Capital Nomura RBC Capital Markets Canaccord Genuity D.A. Davidson & Co. Oppenheimer & Co. Needham & Company

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Prospectus

| Page | ||||

| LETTER FROM DANIEL DINES, CHIEF EXECUTIVE OFFICER, CO-FOUNDER, AND CHAIRMAN |

iii | |||

| 1 | ||||

| 19 | ||||

| 61 | ||||

| 63 | ||||

| 64 | ||||

| 65 | ||||

| 66 | ||||

| 69 | ||||

| MANAGEMENTS DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

72 | |||

| 105 | ||||

| 148 | ||||

| 156 | ||||

| 166 | ||||

| 171 | ||||

| 175 | ||||

| 182 | ||||

| MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES TO NON-U.S. HOLDERS OF OUR CLASS A COMMON STOCK |

186 | |||

| 190 | ||||

| 199 | ||||

| 199 | ||||

| 199 | ||||

| F-1 | ||||

Through and including , 2021 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealers obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

Neither we, the selling stockholders, nor any of the underwriters have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing

-i-

Table of Contents

prospectuses we have prepared. Neither we, the selling stockholders, nor any of the underwriters take responsibility for, or can provide any assurance as to the reliability of, any other information that others may give you. We, the selling stockholders and the underwriters are offering to sell, and seeking offers to buy, shares of our Class A common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our Class A common stock.

For investors outside the United States: neither we, the selling stockholders, nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside of the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of our Class A common stock and the distribution of this prospectus outside of the United States.

-ii-

Table of Contents

Table of Contents

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our Class A common stock. You should read this entire prospectus carefully, including the sections titled Risk Factors, Managements Discussion and Analysis of Financial Condition and Results of Operations, and our consolidated financial statements and the related notes included elsewhere in this prospectus, before making an investment decision. Unless the context otherwise requires, all references in this prospectus to UiPath, the company, we, our, us, or similar terms refer to UiPath, Inc. and its subsidiaries. Our fiscal year ends January 31. Our fiscal quarters end on April 30, July 31, October 31, and January 31. References to fiscal years 2019, 2020, and 2021 in this prospectus refer to our fiscal years ended January 31, 2019, 2020, and 2021.

Our Mission

Our mission is to unlock human creativity and ingenuity by enabling the fully automated enterpriseTM and empowering workers through automation.

Overview

The modern enterprise is complex as employees must navigate an ever-increasing number of systems and applications to perform their day-to-day work. This dynamic forces workers to constantly execute manual, time-consuming, and repetitive tasks to get their work done. The friction faced by workers often results in lost productivity that can have a direct impact on a companys bottom line. Traditional automation solutions intended to reduce this friction have generally been designed to be used by developers and engineers, rather than the employees directly involved in executing the actual work being automated. As a result, employees are limited by the lack of flexibility of these traditional automation technologies causing employee productivity, innovation, and satisfaction to suffer.

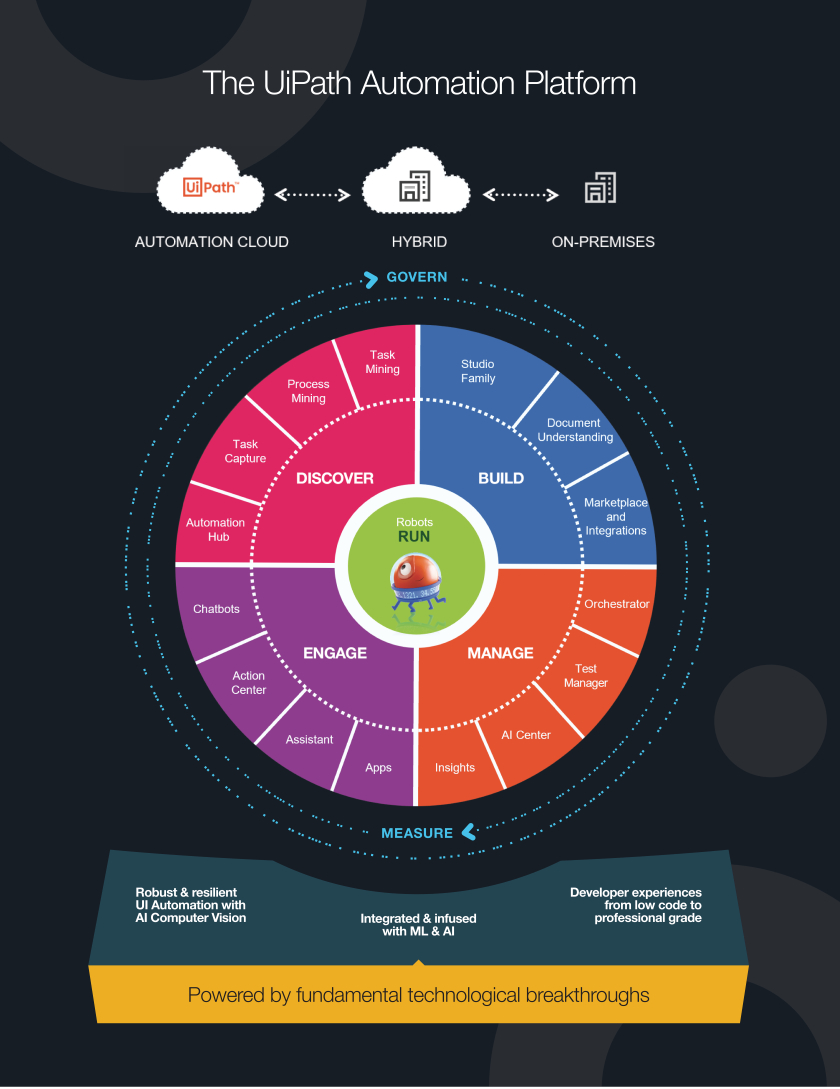

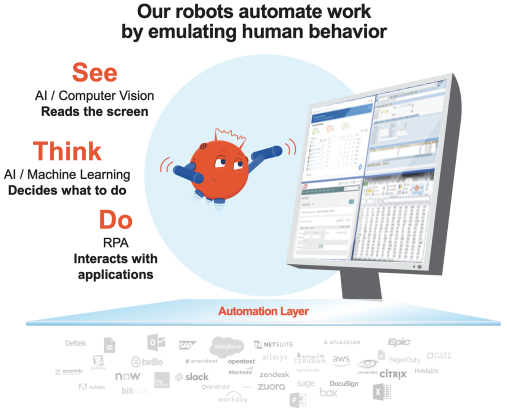

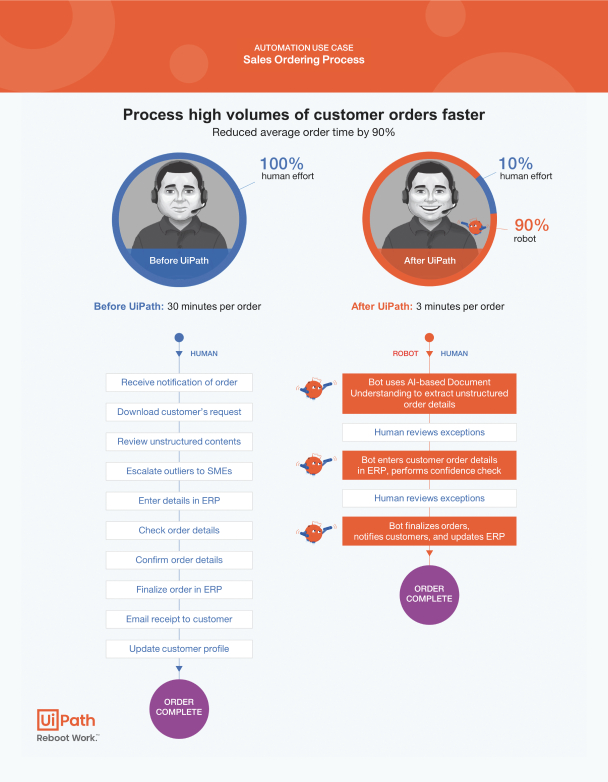

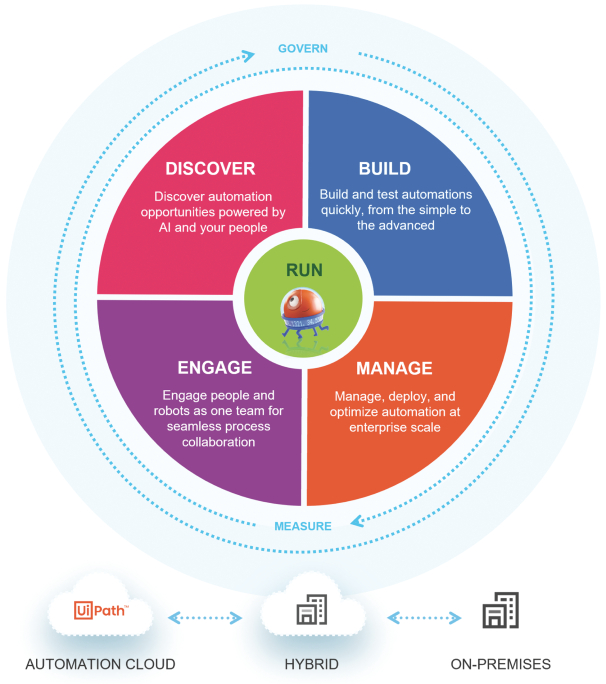

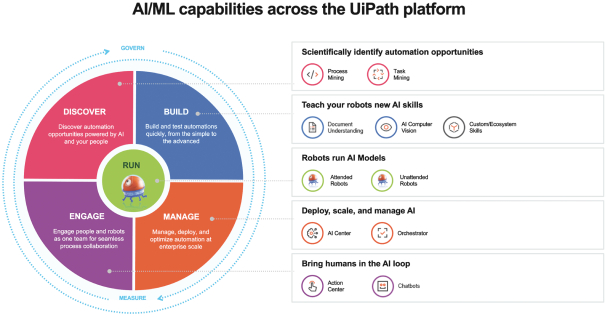

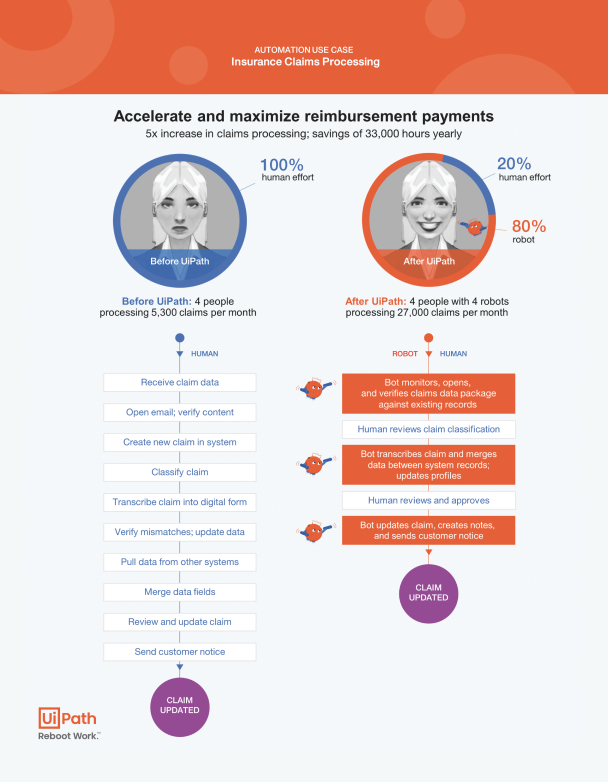

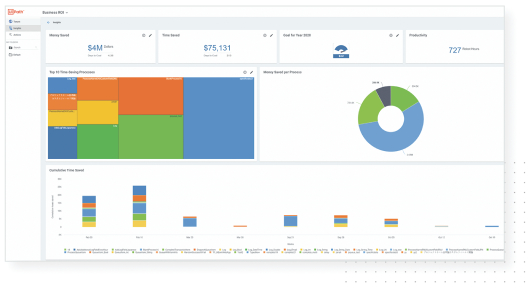

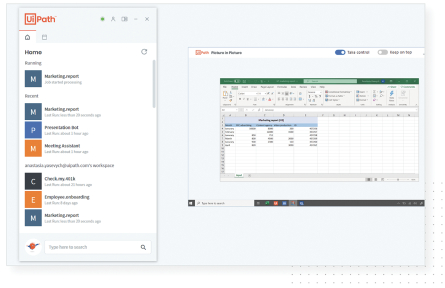

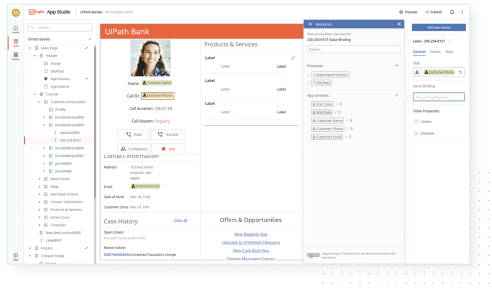

Our platform is designed to transform the way humans work. We provide our customers with a robust set of capabilities to discover automation opportunities and build, manage, run, engage, measure, and govern automations across departments within an organization. Our platform leverages the power of artificial intelligence, or AI, based computer vision to enable our software robots to perform a vast array of actions as a human would when executing business processes. These actions include, but are not limited to, logging into applications, extracting information from documents, moving folders, filling in forms, and updating information fields and databases. Our robots ability to learn from and replicate workers steps in executing business processes drives continuous improvements in operational efficiencies and enables companies to deliver on key digital initiatives with greater speed, agility, and accuracy.

Our platform enables employees to quickly build automations for both existing and new processes. Employees can seamlessly maintain and scale automations across multiple deployment options, constantly improve and evolve automations, and continuously track and measure the performance of automations, all without substantial technical experience.

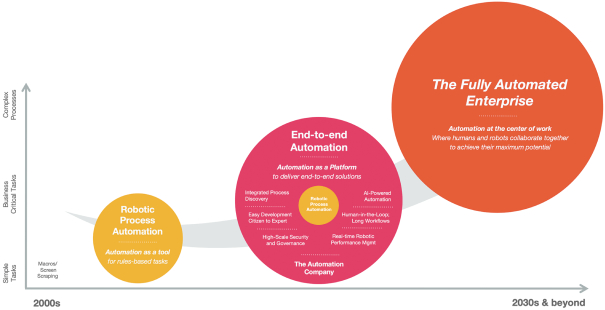

At the core of our automation platform is a set of capabilities that emulates human behavior, which provides our customers with the ability to automate both simple and complex use cases. Automations on our platform can be built, consumed, managed, and governed by any employee who interacts with computers, resulting in the potential for broad applicability of our platform across departments within an organization. Society is at a turning point in how organizations execute work, and we believe the ability to leverage software to enrich the employee experience will unlock tremendous value and efficiency opportunities. While we are still in the early days of a multi-year journey to the fully automated enterprise, momentum is growing as organizations across the world are only now beginning to understand the power of automation.

1

Table of Contents

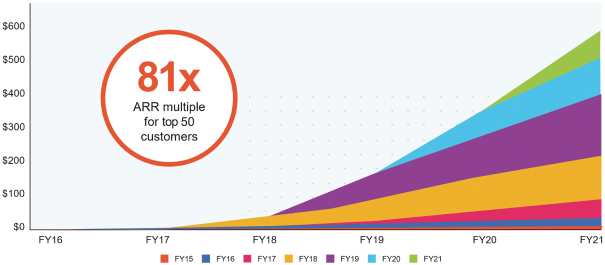

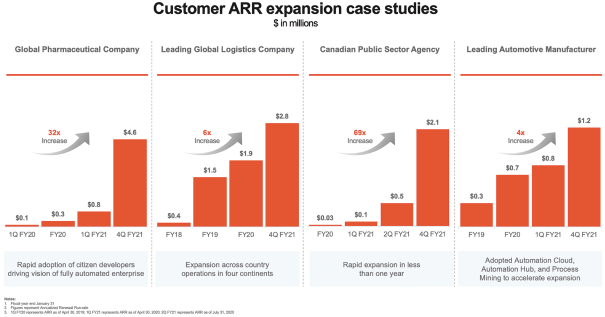

We believe that the success of our land-and-expand business model is centered on our ability to deliver significant value in a very short time. We grow with our customers as they identify and expand the number of business processes to automate, which increases the number of robots deployed and the number of users interacting with our robots. Our ability to expand within our customer base is demonstrated by our dollar-based net retention rate, which represents the rate of net expansion of annualized renewal run-rate, or ARR, from existing customers over the last 12 months. Our dollar-based net retention rate was 153% and 145% as of January 31, 2020 and 2021, respectively. See the sections titled Managements Discussion and Analysis Financial Condition and Result of OperationsKey Factors Affecting Our Performance for additional information regarding our dollar-based net retention rate and Managements Discussion and Analysis Financial Condition and Result of OperationsKey MetricAnnualized Renewal Run-Rate for additional information regarding our ARR.

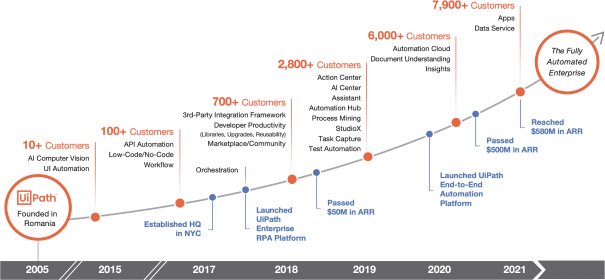

As of January 31, 2020, we had 6,009 customers, including 80% of the Fortune 10 and 61% of the Fortune Global 500. As of January 31, 2021, we had 7,968 customers, including 80% of the Fortune 10 and 63% of the Fortune Global 500. Our customers span a variety of industries and include Adobe, Applied Materials, Chevron, Chipotle Mexican Grill, CrowdStrike, CVS Health, Deutsche Post DHL, EY, Generali, KDDI, SBA Communications, Takeda Pharmaceuticals, and Uber Technologies, Inc.

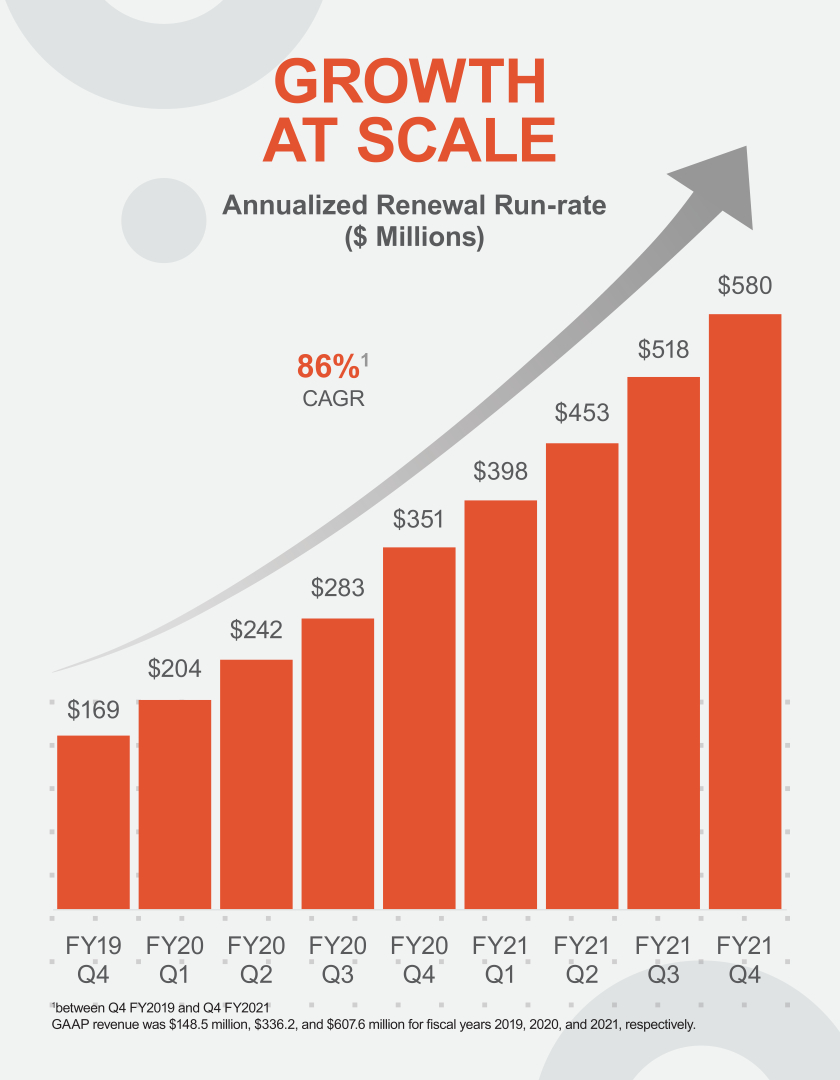

We have experienced rapid growth. Our ARR was $351.4 million and $580.4 million in the fiscal years ended January 31, 2020 and 2021, respectively, representing a growth rate of 65%. We generated revenue of $336.2 million and $607.6 million, representing a growth rate of 81%, and a net loss of $519.9 million and $92.4 million in the fiscal years ended January 31, 2020 and 2021, respectively. Our operating cash flows were $(359.4) million and $29.2 million and our free cash flows were $(380.4) million and $26.0 million in the fiscal years ended January 31, 2020 and 2021, respectively. See the section titled Managements Discussion and Analysis Financial Condition and Result of OperationsNon-GAAP Financial MeasuresNon-GAAP Free Cash Flow for additional information on free cash flow, a non-GAAP measure.

Our Industry

Explosive Growth of Cloud-Based Applications Creating a New Era of IT Complexity. Businesses around the world are spending hundreds of billions of dollars to adopt applications that help advance digital transformation and drive competitive advantages. As a result, enterprises have transitioned from managing a handful of multi-purpose, largely on-premises applications to managing hundreds and even thousands of specialized point solutions deployed across on-premises, cloud, and hybrid environments.

The Benefits of Digital Transformation Have Yet to Make Their Way to the Workforce. Modern enterprise applications enable deep and nuanced functionalities. However, despite massive functional advancement, the true promise and potential of digital transformationreallocating human capital towards cognitive, higher-value activitiesremains elusive, which is limiting improvements in productivity.

Individual Business Processes Rely on Multiple Business Applications, and Workers to Orchestrate Them. The proliferation of specialized applications has resulted in humans being the connective tissue in an enterprise, working across a wide range of applications that individually are not built to address the needs of the actual processes they are supporting.

Automation is the New Frontier of Competitive Differentiation. Enterprises are demanding a new approach to unify, tailor, and run applications without significant information technology, or IT, resources or changes to existing infrastructure. With the ability to emulate human behavior, this new approach to automation is disrupting traditional automation and transforming data processing work by allowing customers to find efficiencies without materially changing business processes and supporting infrastructure.

2

Table of Contents

Empowering Workers to Automate their Personal Workflows is Leading to a Democratization of Automation. The combination of technology that can emulate human behavior and a workforce with the knowledge and tools to create their own automations has enabled enterprises to begin to automate a significant number of use cases, from individual tasks to enterprise-wide processes.

Cost of Skilled Human Capital is Accelerating the Evolution Towards the Fully Automated Enterprise. The cost of skilled human capital continues to rise due to growing demand. We believe it is increasingly imperative for enterprises to leverage automation to liberate workers from menial, repetitive, and less productive tasks and to better utilize the positive qualities that only humans have, such as abstract thinking, making connections, dealing with ambiguity, creativity, innovation, passion, and community engagement. We believe this will drive business value and greater employee engagement.

Limitations of Existing Offerings

A number of technology companies have attempted to address the automation needs of organizations through the application of business process management, application development platform offerings, robotic process automation, or RPA, tools, and AI point offerings, as well as other horizontal software applications. However, these existing offerings are challenged by a number of inherent limitations, including:

Lack of An End-to-End Platform. Many existing automation software offerings are point technologies and cannot offer end-to-end automation capabilities on an integrated platform, which inhibits visibility, insight, and context for discovering and building additional automations.

Not Capable of Emulating Human Behavior, Relying too Heavily on APIs. Many existing offerings do not effectively integrate AI computer vision and machine learning, or ML, capabilities needed to accurately identify and emulate human actions in conjunction with application programming interfaces, or APIs. Without these capabilities, organizations are limited to pursuing automation only within the narrow pathways permitted by existing APIs.

Inability to Automate Across Applications. While business processes typically involve multiple applications, many existing automation capabilities are built into specific applications and are limited in their ability to automate business processes across multiple applications. Accordingly, enterprises build inefficient business processes to compensate for limited cross-functional automation capabilities.

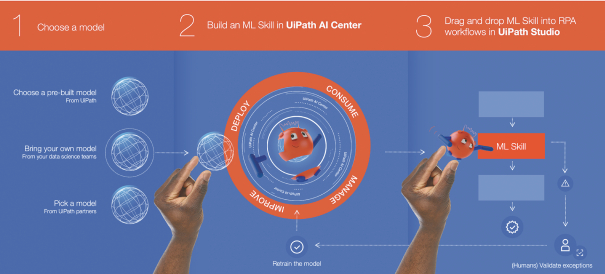

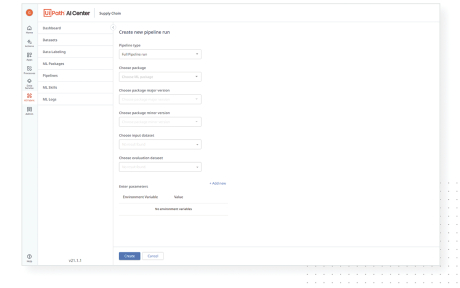

Difficult to Link AI Capabilities to Execution. AI and ML, or AI/ML, capabilities are needed to automate cognitive, high-value tasks. In recent years, enterprises have made significant investments in developing AI/ML models. However, it is difficult to leverage these models as the environments for developing them, typically used by data scientists, are distinct from the environments where work processes are carried out, typically by employees using enterprise applications. This separation of environments limits the ability of an organization to deploy models that are necessary to automate complex processes.

Need to Change an Enterprises Underlying Infrastructure. Existing offerings generally are unable to emulate the humans role in executing a business process, requiring organizations to make significant changes either to their applications and infrastructure or to the business processes themselves.

Unable to Realize Full Value of Automation Throughout an Organization. Existing solutions do not typically make automations accessible to everyone within the organization as they are often built with non-intuitive user interfaces, or UIs, and code heavy technology stacks. These solutions are too technical for most knowledge workers, limiting their application to a small number of use cases and users with significant developer experience.

Lack Governance Capabilities at Scale. Existing offerings do not typically offer centralized, secure governance capabilities to enforce, manage, and deploy organizational development standards.

3

Table of Contents

Difficult to Deploy. Existing automation solutions generally require complicated, invasive implementation processes that, in turn, require extensive upfront and ongoing training and time commitment. This makes it difficult to build and maintain automations, resulting in the persistence of manual processes throughout enterprises.

Lack of Openness and Interoperability. Many existing solutions are not modular and lack the ability to integrate new, third-party technologies and operate with customized applications. Enterprises using these solutions are locked into a limited set of proprietary options not built for the future.

Lack of an Engaged Community of Automation Developers. Many existing automation vendors do not have open platforms and have not invested the time and resources required to cultivate a vibrant ecosystem of automation developers that freely exchange innovations and best practices.

Our Solution and Key Strengths

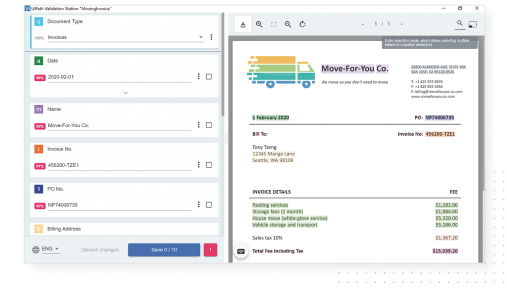

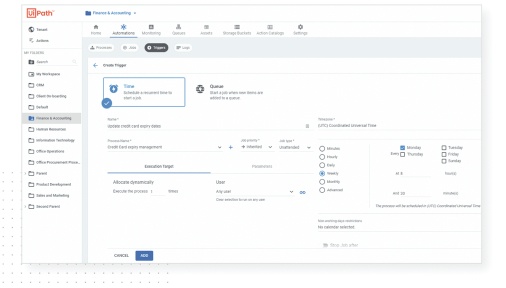

We are at the forefront of technology innovation and thought leadership in automation, creating an end-to-end platform that provides automation with user emulation at its core. Our platform leverages computer vision and AI to empower robots to emulate human behavior and execute specific business processes, eliminating the need for employees to execute certain manual and mundane tasks. Our platform allows employees to focus on more value-added work and enables organizations to seamlessly automate business processes ranging from those in legacy IT systems and on-premises applications to new cloud-native infrastructure and applications without requiring significant changes to the organizations underlying technology infrastructure. Our platform is purpose-built to be used by employees throughout a company and to address a wide variety of use cases, from simple tasks to long-running, complex business processes.

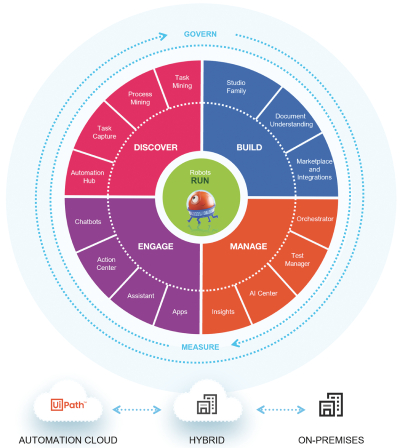

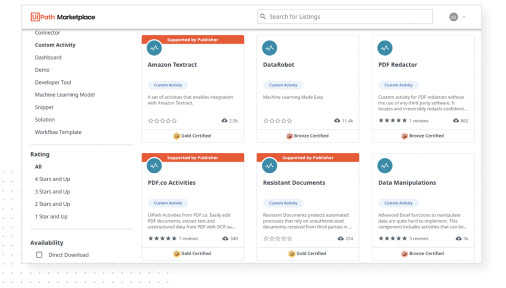

Broad Set of Complementary Solutions. Our platform combines computer vision, AI, ML, RPA, and process-discovery capabilities to enable automations across deployment environments, systems, and applications. We provide our customers with a comprehensive set of capabilities to discover, build, manage, run, engage, measure, and govern automations across departments and personas within an organization or agency.

Open Architecture. Our platform embraces an open ecosystem with hundreds of enterprise application integrations that have been built by both UiPath and the UiPath community of technology partners. Our solution includes a variety of pre-built activities and connectors so customers can quickly create and deploy robots that execute operations and seamlessly interact with third-party systems. Our open ecosystem is architecture agnostic, which allows organizations to automate existing infrastructure and accelerate digital innovation without the need to replace or make large investments in their existing infrastructure.

Built-In AI/ML Capabilities. We incorporate proprietary AI/ML into our products to drive continuous improvement of workflows. Our AI/ML capabilities broaden the applicability of our solution to address complex use cases. Our platform can learn from human interactions to continuously improve the quality and accuracy of AI algorithms and ML models.

Human Emulation Enables Addressing Expansive Use Cases. Our robots emulate human behavior and are adaptable to constantly changing external variables. Our robots ability to emulate human behavior allows organizations to leverage our platform to address a myriad of use cases, from the simple to the complex. We believe that the power of our platform is only limited by the use cases that human users can conceive.

Built for Enterprise Deployment. Our platform grows with our customers as they increase the automation footprint across their organizations. Customers can deploy our platform on-premises, in a public or private cloud, or in a hybrid environment. Our platform has been architected with security and governance at its core allowing our customers to seamlessly grow their automation footprints while giving their IT departments the tools to establish necessary guardrails around the automations.

4

Table of Contents

Adoption Across Workers and Functions. We make automation accessible to workers throughout an organization. Workers can interact with our robots in many of the same ways that they would interact with humans.

Simple, Intuitive, Quickly Deployed. Our platform is easy to use. Automations can be quickly and efficiently deployed across an organization, creating immediate time-to-value.

Resilient Automations. Our platform was built to emulate the actions of a human interacting with applications and systems to execute processes. Our robots can emulate human behavior by leveraging our proprietary AI-based computer vision capabilities to adapt and respond to changes in work environments such as interpreting highly varied document types or navigating unstable UIs. Our proprietary, AI-based computer vision also allows for increased reliability and accommodation to changes in display resolution, scale, and UI changes. In addition, we have developed a variety of features that are designed to enable resiliency in the process and execution of building automations.

Integrated and Portable AI/ML Models. Our platform enables companies to easily deploy, manage, and improve AI/ML models built by our customers or third parties allowing for greater allocation of human capital towards business problems and use cases. Our pre-trained AI/ML models have been designed for deployment and customization without the need for a data science or technical background.

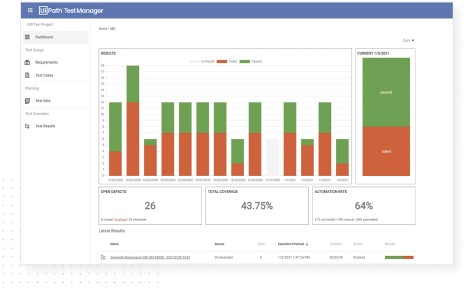

Automation Performance and Business Outcome Analytics. Our platform tracks, measures, and forecasts the performance of automations enabling customers to gain powerful insights and generate key performance indicators with actionable metrics.

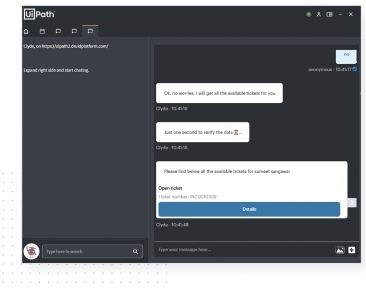

Built for Collaboration. Our platform was designed for people and robots to work together, allowing each to focus on the processes they execute best. Robots execute the time-consuming, manual processes that make work less interesting and satisfying, freeing up humans to think more creatively, innovate, solve complex problems, and improve customer experiences.

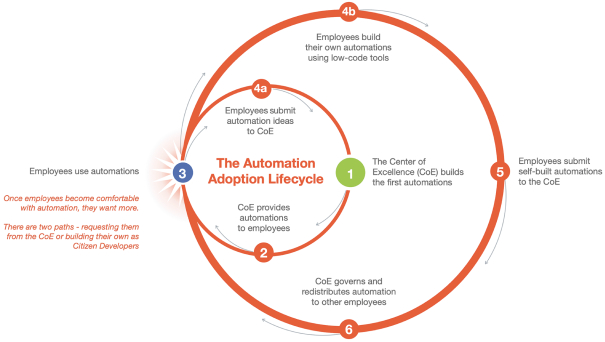

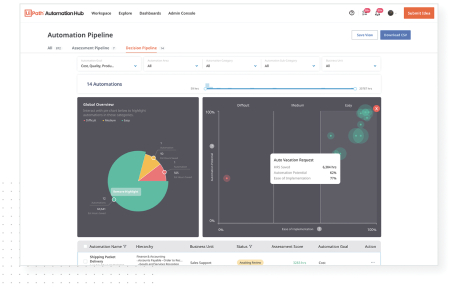

Accelerating the Adoption of Automation within the Enterprise

The adoption of our platform is fueled by the virality of our products, which together help organically scale our solution within an organization from the bottom up. Most of our customers start their automation journey with the development of a Center of Excellence, or COE. The COE focuses on building automations for simple, widely applicable tasks and provides those automations to the employee base to use in their day-to-day work right from their desktop. As employees become increasingly familiar and comfortable with automations, they start to build useful automations on their own, and submit these to the COE for assessment and, once approved, these automations are then deployed to the rest of the organization. This flywheel continues, spreading development across the entire enterprise and helping organically surface numerous automation ideas that likely could not be achieved through a traditional top-down approach.

Key Benefits to Organizations

Our end-to-end platform is purpose-built to power the fully automated enterprise. Our platform is designed to remove the friction that exists across employees and departments by improving transparency, promoting collaboration, and allowing people to focus on the work that matters. We enable organizations to implement highly customized, agile, and fast automations with lower overall IT infrastructure costs, with the goal of creating short time to value, improved efficiency, and increased innovation. Our platform provides the following key benefits to organizations:

Empower Customers to Deliver on Digital Initiatives. Our platform helps organizations accelerate innovation, increase productivity, drive competitive differentiation, and enrich employee and customer

5

Table of Contents

experiences by reducing the time to complete work from days and hours to minutes and seconds, allowing employees to focus on more mission-critical and innovative work.

Build Business Resiliency and Agility into Digital Business Operations. Our platform provides customers with the necessary flexibility to operate under constantly changing conditions and offers customers a virtually unlimited digital workforce capacity that operates 24 hours per day, 7 days per week.

Fast Time-to-Value. We believe our solution delivers immediate return on investment. Our platform is designed to be easy to install and intuitive to learn and use, minimizing the need for lengthy and expensive implementation and training.

Organization-Wide Automation. Our powerful and easy-to-use platform enables workers throughout an organization to build automations. Our platform is designed to automate the full spectrum of business processes and tasks, from individual tasks to complex processes that address entire enterprise divisions. We offer a development platform that reduces the technical skills required of users, effectively democratizing automation to employees throughout an organization.

Identify, Improve, and Analyze Workflow Execution. Our platform provides visibility into how work actually gets done and enables our customers to continually understand, identify, and implement automation opportunities. Our solution leverages advanced process-discovery technologies and ML models to understand individual patterns for executing work and respond to bottlenecks and inefficiencies.

Improve Employee Productivity, Experience, and Satisfaction. Our platform enables organizations to empower their employees with countless automation possibilities and the ability to digitize time-consuming, manual tasks. As a result, our customers are better positioned to retain a high-value, engaged employee base that can deliver optimal business outcomes.

Improve Accuracy and Compliance with Speed. The quick deployment and adaptability of our platform is designed to eliminate costly errors and inconsistencies that are common among individuals executing manual tasks.

Enhance Customer Experiences. Organizations leverage our robots to resolve customer issues faster and more efficiently.

Key Benefits to Employees

Our platform is designed to eliminate the need for employees to execute low-value, manual tasks, freeing up time to focus on more meaningful, strategic work. We believe the democratization of automation leads to the following benefits tied to an improved employee experience:

| | greater professional fulfillment and job satisfaction; |

| | increased creativity and innovation; |

| | improved performance and accuracy; |

| | enhanced skillsets; |

| | increased autonomy and job opportunities; and |

| | more collaboration and better human interactions. |

6

Table of Contents

Our Market Opportunity

We are disrupting a large and fast-growing market. Our platform addresses the market for Intelligent Process Automation, which International Data Corporation, or IDC, estimated would have a value of $17 billion by the end of 2020 and is expected to grow at a four-year compound annual growth rate of approximately 16% to $30 billion by the end of 2024. However, we believe that this does not fully encompass the opportunity associated with our vision of the fully automated enterprise.

We estimate our current global market opportunity to be more than $60 billion, which we expect will grow as automation adoption increases and customers continue to further explore the use cases that our platform addresses. To estimate our total market opportunity, we identified the number of companies worldwide across all industries with at least 200 employees, based on certain independent industry data from the S&P Capital IQ database. We then segmented these companies into three categories based on total number of employees: companies with 200-4,999 employees, companies with 5,000-19,999 employees, and companies with 20,000 or more employees. We then multiplied the number of companies in each category by the 90th percentile of ARR per customer in each such cohort as of December 31, 2020, among customers with at least $10,000 in ARR, which we believe represents a customer that has broadly deployed our platform across the enterprise, and then summed the results from each category.

According to an estimate by Bain & Company in the report Beyond Cost Savings: Reinventing Business Through Automation, the expansion of automation platforms by incorporating broader capabilities and technologies has increased the size of the addressable market for automation software to approximately $65 billion.

The size of our addressable market opportunity is underpinned by the substantial amount of business processes that could be improved through automation, but are not currently automated. Forrester, a global research firm, estimated there were 1.69 billion knowledge workers globally as of February 2021. We expect our estimated global market opportunity will continue to expand as customers increase the size of their business units and hire additional employees, resulting in a greater number of users and processes that can benefit from automation throughout these enterprises. Additionally, we believe that we are unlocking a myriad of still unexplored automation possibilities as we continue to contribute to this market. We believe those possibilities represent a significant greenfield opportunity for us.

Organizations across the world are only beginning to understand the power of automation and we believe we are at the forefront of a revolution in the way that people do work. We believe that the opportunity that lies ahead of us is largely untapped and has the potential to be one of the largest ever in enterprise software.

For more information regarding certain assumptions underlying these estimates of market opportunity and the forecasts of market growth included in this prospectus, see the section titled Market, Industry, and Other Data.

Our Growth Strategies

We are pursuing a large market opportunity with growth strategies that include:

| | acquire new customers; |

| | expand within our existing customer base; |

| | grow and cultivate our partner and channel network; |

| | extend our technology leadership through continued innovation and investment in our platform; |

| | foster the next generation of workers and grow our community; |

7

Table of Contents

| | continue to invest in major markets; and |

| | opportunistically pursue strategic acquisitions. |

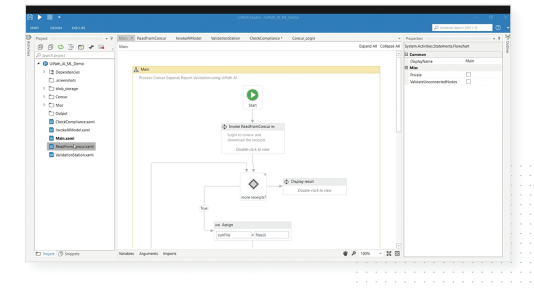

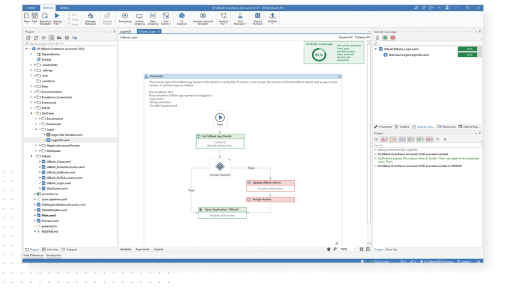

Our Platform

Our platform is purpose-built to advance the next generation of automation. By addressing the complete lifecycle of automation, including identifying specific tasks and processes to automate, building, and managing automation robots, deploying them to execute processes, and measuring their business impact, our platform is intended to address a wide and diverse array of automation opportunities, including complex, long-running workflows. We believe our platform delivers compelling ease-of-use and intuitive user experiences through our low-code development environment and seamlessly integrates with an ever-expanding ecosystem of third-party technologies and enterprise applications without changing the existing infrastructure of an organization. In doing all of this, we enable businesses to redefine the relationship between enterprise applications and business processes.

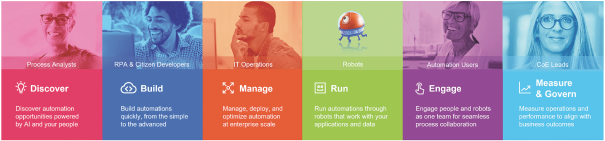

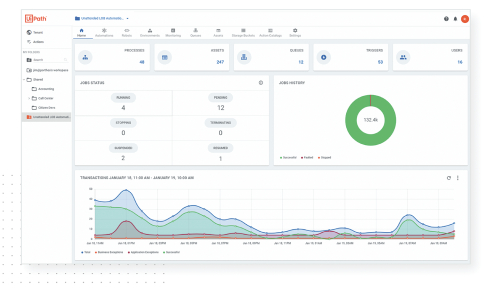

Our platform encapsulates seven modular product pillars that together address the automation lifecycle within an enterprise:

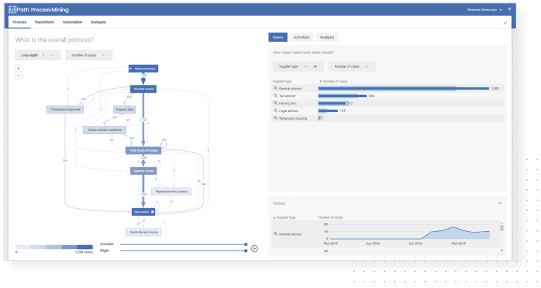

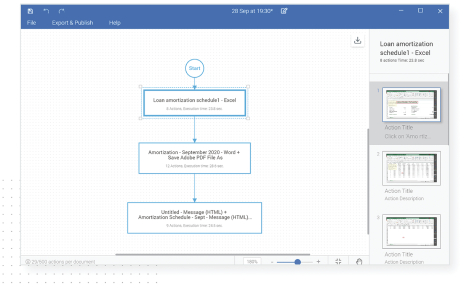

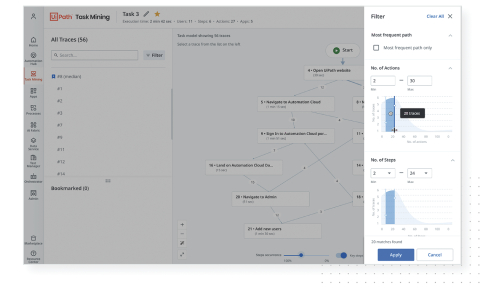

| | Discover. Our Discover products combine AI with desktop recording, back-end mining of both human activity and system logs, and intuitive visualization tools, enabling users to discover, analyze, and identify unique processes to automate in a centralized portal. |

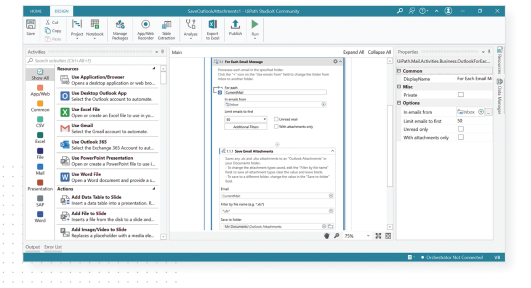

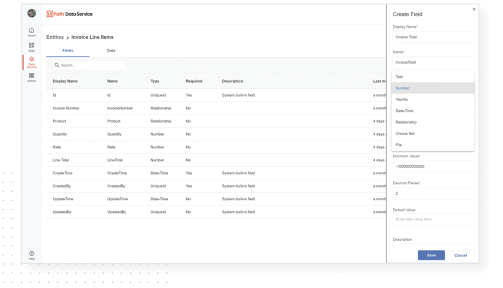

| | Build. Our Build products are low-code development environments with easy-to-use, drag-and-drop functionality that users in an organization can learn to use to create attended and unattended automations without any prior knowledge of coding. |

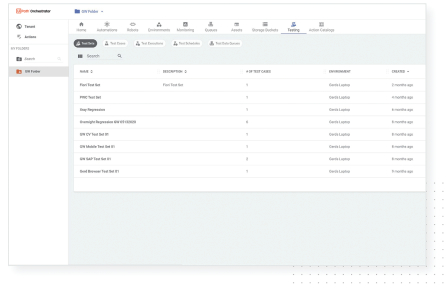

| | Manage. The products in our Manage category offer centralized tools designed to securely and resiliently manage, test, and deploy automations and ML models across the entire enterprise, with seamless access, enterprise-grade security, and endless scalability of data. |

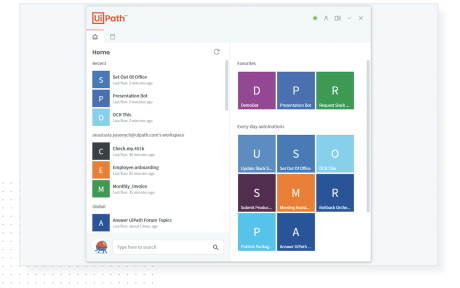

| | Run. With our Run products, an enterprise can deploy our robots in highly immersive attended experiences or in standalone, unattended modes behind the scenes, and can leverage hundreds of native connectors built for commonly used line-of-business applications. |

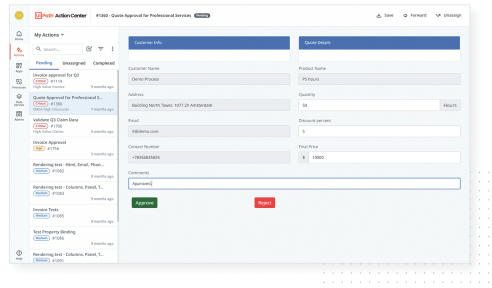

| | Engage. With our Engage products, there are multiple ways for users to remain connected and interact with robots, whether they are running in a data center, in the cloud, or right on their desktop. This capability allows our customers to manage long running processes that orchestrate work between robots and humans. |

| | Measure. Our Measure products enable users to track, measure, and forecast the performance of automation in their enterprise. |

| | Govern. We offer powerful, centralized governance capabilities designed to help businesses ensure compliance with business standards. |

Our platform is powered by the following key differentiating elements that are necessary for end-to-end automation within todays enterprise:

| | AI Computer Vision. Our robots are powered by a multi-pronged approach, combining proprietary computer vision technology that uses highly-trained AI with technical introspection of visual hierarchy to dynamically recognize and interact with constantly changing elements of on-screen documents, images, and applications. |

8

Table of Contents

| | Fully AI-Enabled Platform. We have purposefully infused our platform with AI to enable organizations to use our products easily and deeply embed AI into their core operations. |

| | Document Understanding. We combine our proprietary computer vision technology with optical character recognition, natural language processing, and a variety of ML technologies to classify and extract data from unstructured, semi-structured, and structured documents and images, handwriting, and scans. |

| | Low-Code Development Experiences. Our platform is built to be intuitive and easy to use with low-code, drag-and-drop development tools, and interfaces that knowledge workers can understand. |

| | Widespread and Rich Human and Robot Interaction. Our platform facilitates a broad array of interactions between humans and robots, allowing users to easily engage with robots when, where, and how they want. |

| | Enterprise-Grade Governance and Security. We deliver centralized governance and data security capabilities built for businesses to securely and resiliently deploy and manage automations at enterprise scale. |

| | Open and Extensible Platform Architecture. Our platform delivers both UI automation and API integration on a single platform. We offer hundreds of out-of-the-box, native integrations with a wide range of enterprise applications and productivity tools from our technology partners. |

| | Flexible Deployment. We have built our platform to be multi-tenant and deployable across on-premises, private and public cloud, and hybrid environments to meet any level of scaling, availability, and infrastructure requirements. |

Risk Factors Summary

Investing in our Class A common stock involves substantial risk. The risks described in the section titled Risk Factors immediately following this summary may cause us to not realize the full benefits of our strengths or may cause us to be unable to successfully execute all or part of our strategy. Some of the more significant challenges include the following:

| | Our recent rapid growth may not be indicative of our future growth. Our limited operating history and recent rapid growth also make it difficult to evaluate our future prospects and may increase the risk that we will not be successful. |

| | We may not be able to successfully manage our growth and, if we are not able to grow efficiently, our business, financial condition, and results of operations could be harmed. |

| | Because we derive substantially all of our revenue from our automation platform, failure of this platform to satisfy customer demands could adversely affect our business, results of operations, financial condition, and growth prospects. |

| | Our business depends on our existing customers renewing their licenses and purchasing additional licenses and products from us and our channel partners. Declines in renewals or the purchase of additional licenses by our customers could harm our future operating results. |

| | If we are unable to attract new customers, our business, financial condition, and results of operations will be adversely affected. |

9

Table of Contents

| | The markets in which we participate are competitive and, if we do not compete effectively, our business, financial condition, and results of operations could be harmed. |

| | If we fail to retain and motivate members of our management team or other key employees, or fail to attract additional qualified personnel to support our operations, our business and future growth prospects would be harmed. |

| | Unfavorable conditions in our industry or the global economy, or reductions in IT spending, could limit our ability to grow our business and negatively affect our results of operations. |

| | A limited number of customers represent a substantial portion of our revenue and ARR. If we fail to retain these customers, our revenue could decline significantly. |

| | We rely on our channel partners to generate a substantial amount of our revenue, and if we fail to expand and manage our distribution channels, our revenue could decline and our growth prospects could suffer. |

| | If we are not able to introduce new features or services successfully and to make enhancements to our platform or products, our business and results of operations could be adversely affected. |

| | Real or perceived errors, failures, or bugs in our platform and products could adversely affect our business, results of operations, financial condition, and growth prospects. |

| | Incorrect or improper implementation or use of our platform and products could result in customer dissatisfaction and harm our business, results of operations, financial condition, and growth prospects. |

| | We rely upon third-party providers of cloud-based infrastructure to host our cloud-based products. Any disruption in the operations of these third-party providers, limitations on capacity, or interference with our use could adversely affect our business, financial condition, and results of operations. |

| | We expect fluctuations in our financial results, making it difficult to project future results, and if we fail to meet the expectations of securities analysts or investors with respect to our results of operations, our stock price and the value of your investment could decline. |

| | If we fail to maintain and enhance our brand, our ability to expand our customer base will be impaired and our business, financial condition, and results of operations may suffer. |

| | Any failure to obtain, maintain, protect, or enforce our intellectual property and proprietary rights could impair our ability to protect our proprietary technology and our brand. |

| | We may become subject to intellectual property disputes, which are costly and may subject us to significant liability and increased costs of doing business. |

| | Our current operations are international in scope, and we plan further geographic expansion, creating a variety of operational challenges. |

| | We and our independent registered public accounting firm identified a material weakness in our internal control over financial reporting in the past, and any failure to maintain effective internal control over financial reporting could harm us. |

10

Table of Contents

| | The dual class structure of our common stock will have the effect of concentrating voting control with our Chief Executive Officer, Co-Founder, and Chairman, which will limit your ability to influence the outcome of important decisions. |

Corporate Information

We were founded in Bucharest, Romania in 2005 and incorporated in Delaware on June 9, 2015. Our principal executive offices are located at 90 Park Avenue, 20th Floor, New York, New York 10016, and our telephone number is (844) 432-0455. Our website address is www.uipath.com. Information contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus, and you should not consider information on our website to be part of this prospectus.

The UiPath logo, UiPath, Automation Cloud, and our other registered and common law trade names, trademarks, and service marks are the property of UiPath, Inc. or our subsidiaries. Other trade names, trademarks, and service marks used in this prospectus are the property of their respective owners.

Our Fiscal Year

Our fiscal year ends on January 31 each year. See Note 2 to our consolidated financial statements included elsewhere in this prospectus for additional details related to our fiscal year.

Implications of Being an Emerging Growth Company

We are an emerging growth company as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. We may take advantage of certain exemptions from various public company reporting requirements, including not being required to have our internal control over financial reporting audited by our independent registered public accounting firm under Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and any golden parachute payments. We may take advantage of these exemptions for up to five years or until we are no longer an emerging growth company, whichever is earlier. In addition, the JOBS Act provides that an emerging growth company can delay adopting new or revised accounting standards until those standards apply to private companies. We have elected to use the extended transition period under the JOBS Act. Accordingly, our financial statements may not be comparable to the financial statements of public companies that comply with such new or revised accounting standards.

11

Table of Contents

THE OFFERING

| Class A common stock offered by us |

9,416,384 shares |

| Class A common stock offered by the selling stockholders |

14,474,393 shares |

| Option to purchase additional shares of Class A common stock offered by us |

3,583,616 shares |

| Class A common stock to be outstanding after this offering |

436,700,983 shares |

| Class B common stock to be outstanding after this offering |

82,452,748 shares |

| Total Class A common stock and Class B common stock to be outstanding after this offering |

519,153,731 shares |

| Use of proceeds |

We estimate that our net proceeds from the sale of our Class A common stock that we are offering will be approximately $467.4 million (or approximately $647.9 million if the underwriters option to purchase additional shares of our Class A common stock from us is exercised in full), assuming an initial public offering price of $53.00 per share, the midpoint of the estimated price range set forth on the cover page of this prospectus, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We will not receive any proceeds from the sale of shares of our Class A common stock by the selling stockholders. |

| The principal purposes of this offering are to increase our capitalization and financial flexibility, facilitate an orderly distribution of shares for the selling stockholders, create a public market for our Class A common stock, and facilitate our future access to the capital markets. As of the date of this prospectus, we cannot specify with certainty all of the particular uses for the net proceeds to us from this offering. However, we currently intend to use the net proceeds we receive from this offering for general corporate purposes, including working capital, operating expenses, and capital expenditures. We also intend to donate up to $0.6 million of the net proceeds of this offering to fund our social impact and environmental, social, and governance initiatives, as more fully described in BusinessSocial Responsibility and Community Initiatives. We may use a portion of the net proceeds to acquire complementary businesses, products, services, or technologies. At this time, we do not have agreements or commitments to enter into any material acquisitions. See the section titled Use of Proceeds for additional information. |

12

Table of Contents

| Directed share program |

At our request, Morgan Stanley & Co. LLC (the DSP Underwriter) has reserved up to 2.0% of the shares of Class A common stock offered by this prospectus for sale at the initial public offering price to certain individuals identified by our officers and directors who express an interest in purchasing Class A common stock in this offering. The shares sold under the directed share program will not be subject to a lock-up, except for any shares purchased by our officers and directors. The number of shares of Class A common stock available for sale to the general public will be reduced by the number of reserved shares sold to these individuals. Any reserved shares of our Class A common stock that are not so purchased will be offered by the DSP Underwriter to the general public on the same terms as the other shares of our Class A common stock offered by this prospectus. We have agreed to indemnify the DSP Underwriter and its affiliates against certain liabilities and expenses, including liabilities under the Securities Act, in connection with sales of the reserved shares. For additional information, see the section titled Underwriting. |

| Voting rights |

We will have two classes of common stock: Class A common stock and Class B common stock. Each share of Class A common stock is entitled to one vote and each share of Class B common stock is entitled to 35 votes and is convertible at any time into one share of Class A common stock. In addition, all shares of Class B common stock will automatically convert into shares of Class A common stock in certain circumstances, including following the date that the number of shares of Class B common stock outstanding is less than 20% of the number of shares of Class B common stock outstanding immediately prior to the completion of this offering. See the section titled Description of Capital StockClass A Common Stock and Class B Common Stock. |

| Holders of Class A common stock and Class B common stock will generally vote together as a single class, unless otherwise required by law or our amended and restated certificate of incorporation that will be in effect on the closing of this offering. Our Chief Executive Officer, Co-Founder, and Chairman, Daniel Dines, and his controlled entities hold 100% of our outstanding Class B common stock and will hold approximately 88.1% of the voting power of our outstanding shares following this offering (or 88.0% of the voting power of our outstanding shares following this offering if the |

13

Table of Contents

| underwriters exercise their option in full to purchase additional shares of Class A common stock to cover over-allotments). As a result, Mr. Dines will have the ability to control the outcome of matters submitted to our stockholders for approval, including the election of our directors and the approval of any change in control transaction. See the sections titled Principal and Selling Stockholders and Description of Capital Stock for additional information. |

| Risk factors |

You should carefully read the section titled Risk Factors beginning on page 19 and the other information included in this prospectus for a discussion of facts that you should consider before deciding to invest in shares of our Class A common stock. |

| Proposed New York Stock Exchange trading symbol |

PATH |

The number of shares of Class A common stock and Class B common stock that will be outstanding after this offering as noted above is based on 425,901,431 shares of Class A common stock and 83,835,916 shares of Class B common stock outstanding as of January 31, 2021, and excludes:

| | 5,175,906 shares of Class A common stock issuable on the exercise of stock options outstanding as of January 31, 2021 under the UiPath, Inc. 2015 Stock Plan, or the 2015 Plan, with a weighted-average exercise price of $0.07 per share; |

| | 17,836,792 shares of Class A common stock issuable on the exercise of stock options outstanding as of January 31, 2021 under the UiPath, Inc. 2018 Stock Plan, or the 2018 Plan, with a weighted-average exercise price of $2.02 per share; |

| | 146,549 shares of Class A common stock issuable on the exercise of stock options granted after January 31, 2021 under the 2018 Plan, with a weighted-average exercise price of $0.10 per share; |

| | 16,646,293 shares of Class A common stock issuable on the vesting and settlement of RSUs outstanding as of January 31, 2021 under the 2018 Plan for which the performance-based vesting condition will be satisfied in connection with this offering, but for which the service-based vesting condition will not be satisfied on or before the date of this offering; |

| | 2,812,974 shares of Class A common stock issuable upon the vesting and settlement of RSUs granted after January 31, 2021 under the 2018 Plan for which the performance-based vesting condition will be satisfied in connection with this offering, but for which the service-based vesting condition will not be satisfied on or before the date of this offering; |

| | 60,109,479 shares of Class A common stock reserved for future issuance under our 2021 Equity Incentive Plan, or 2021 Plan, as well as any future increases, including annual automatic evergreen increases, in the number of shares of Class A common stock reserved for issuance thereunder, and any shares underlying stock awards outstanding under the 2015 Plan or the 2018 Plan that expire or are repurchased, forfeited, canceled, or withheld; |

| | 10,500,000 shares of Class A common stock reserved for issuance under our employee stock purchase plan, or ESPP, as well as any future increases, including annual automatic evergreen increases, in the number of shares of Class A common stock reserved for future issuance under our ESPP; and |

14

Table of Contents

| | 2,810,082 shares of our Class A common stock that we have reserved and may donate to fund our social impact and environmental, social, and governance initiatives, as more fully described in BusinessSocial Responsibility and Community Initiatives. |

In addition, unless we specifically state otherwise, the information in this prospectus reflects:

| | a 10-for-1 forward stock split of our then-outstanding Class A common stock, Class B common stock, and each series of convertible preferred stock effected on June 6, 2018 without any change in the par value per share; |

| | a 3-for-1 forward stock split of our then-outstanding Class A common stock, Class B common stock, and each series of convertible preferred stock effected on July 9, 2020 without any change in the par value per share; |

| | the conversion of 26,817,582 shares of Class B common stock into an equivalent number of shares of Class A common stock prior to the closing of this offering, or the Class B Conversion; |

| | the filing of our amended and restated certificate of incorporation and the effectiveness of our amended and restated bylaws, each of which will occur immediately prior to the closing of this offering; |

| | the net issuance of 17,606,860 shares of Class A common stock following the closing of this offering from the settlement of certain outstanding RSUs for which the service based vesting condition was satisfied on or before the date of this offering and for which the performance-based vesting condition will be satisfied in connection with this offering; |

| | the conversion of all outstanding shares of convertible preferred stock into an aggregate of 306,300,407 shares of Class A common stock, which will occur immediately prior to the closing of this offering, and which includes the 12,043,202 shares of our Series F convertible preferred stock issued and sold in February 2021 for an aggregate purchase price of approximately $750.0 million in private placements, or the Series F Financing; |

| | no exercise of the underwriters option to purchase up to an additional 3,583,616 shares of Class A common stock from us in this offering; |

| | no exercise of the outstanding stock options or settlement of the outstanding RSUs described above for which the service-based vesting condition will not be satisfied on or before the date of this offering; and |

| | no purchase of our Class A common stock by executive officers, directors and existing stockholders through the directed share program described under Underwriting. |

15

Table of Contents

Summary Consolidated Financial and Other Data

The summary consolidated statement of operations data for the fiscal years ended January 31, 2020 and 2021 and the summary consolidated balance sheet data as of January 31, 2021 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary consolidated statement of operations data for the fiscal year ended January 31, 2019 has been derived from our unaudited consolidated financial statements not included in this prospectus. We have prepared the unaudited financial information on the same basis as the audited consolidated financial statements and have included, in our opinion, all adjustments, consisting only of normal recurring adjustments, we consider necessary for a fair statement of the financial information set forth in those statements. You should read the consolidated financial data set forth below in conjunction with our consolidated financial statements and the accompanying notes and the information in the section titled Managements Discussion and Analysis of Financial Condition and Results of Operations contained elsewhere in this prospectus. Our historical results are not necessarily indicative of the results to be expected for the full year or any other period in the future.

| Fiscal Year Ended January 31, | ||||||||||||

| 2019 | 2020 | 2021 | ||||||||||

| (in thousands except share and per share amounts) |

||||||||||||

| Consolidated Statement of Operations Data |

||||||||||||

| Revenue: |

||||||||||||

| Licenses |

$ | 94,910 | $ | 201,648 | $ | 346,035 | ||||||

| Maintenance and support |

47,287 | 119,612 | 232,542 | |||||||||

| Services and other |

6,268 | 14,896 | 29,066 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total revenue |

148,465 | 336,156 | 607,643 | |||||||||

|

|

|

|

|

|

|

|||||||

| Cost of revenue: |

||||||||||||

| Licenses |

472 | 3,760 | 7,054 | |||||||||

| Maintenance and support(1) |

6,669 | 16,503 | 24,215 | |||||||||

| Services and other(1) |

35,187 | 39,142 | 34,588 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total cost of revenue |

42,328 | 59,405 | 65,857 | |||||||||

|

|

|

|

|

|

|

|||||||

| Gross profit |

106,137 | 276,751 | 541,786 | |||||||||

|

|

|

|

|

|

|

|||||||

| Operating expenses: |

||||||||||||

| Sales and marketing(1) |

189,717 | 483,344 | 380,154 | |||||||||

| Research and development(1) |

66,923 | 131,066 | 109,920 | |||||||||

| General and administrative(1) |

106,688 | 179,624 | 162,035 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total operating expenses |

363,328 | 794,034 | 652,109 | |||||||||

|

|

|

|

|

|

|

|||||||

| Operating loss |

(257,191 | ) | (517,283 | ) | (110,323 | ) | ||||||

| Interest income |

1,172 | 6,741 | 1,152 | |||||||||

| Other (expense) income, net |

(2,819 | ) | (6,597 | ) | 14,513 | |||||||

|

|

|

|

|

|

|

|||||||

| Loss before income taxes |

(258,838 | ) | (517,139 | ) | (94,658 | ) | ||||||

| Provision for (benefit from) income taxes |

2,811 | 2,794 | (2,265 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| Net loss |

$ | (261,649 | ) | $ | (519,933 | ) | $ | (92,393 | ) | |||

|

|

|

|

|

|

|

|||||||

| Net loss per share attributable to common stockholders, basic and diluted(2) |

$ | (1.67 | ) | $ | (3.41 | ) | $ | (0.55 | ) | |||

|

|

|

|

|

|

|

|||||||

| Weighted-average shares used to compute net loss per share attributable to common stockholders, basic and diluted(2) |

156,954,470 | 152,382,428 | 168,255,480 | |||||||||

|

|

|

|

|

|

|

|||||||

16

Table of Contents

| Fiscal Year Ended January 31, | ||||||||||||

| 2019 | 2020 | 2021 | ||||||||||

| (in thousands except share and per share amounts) |

||||||||||||

| Pro forma net loss per share attributable to common stockholders, basic and diluted (unaudited)(3) |

$ | (0.64 | ) | |||||||||

|

|

|

|||||||||||

| Weighted-average shares used to compute pro forma net loss per share attributable to common stockholders, basic and diluted (unaudited)(3) |

492,162,747 | |||||||||||

|

|

|

|||||||||||

| Other Data |

||||||||||||

| Annualized renewal run-rate (ARR)(4) |

$ | 168,528 | $ | 351,441 | $ | 580,483 | ||||||

| (1) | Includes stock-based compensation expense as follows: |

| Fiscal Year Ended January 31, | ||||||||||||

| 2019 | 2020 | 2021 | ||||||||||

| (in thousands) | ||||||||||||

| Cost of revenue |

$ | 1,236 | $ | 2,813 | $ | 2,373 | ||||||

| Sales and marketing |

13,234 | 26,754 | 16,356 | |||||||||

| Research and development |

37,852 | 45,235 | 11,435 | |||||||||

| General and administrative |

64,082 | 63,060 | 56,003 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total stock-based compensation expense |

$ | 116,404 | $ | 137,862 | $ | 86,167 | ||||||

|

|

|

|

|

|

|

|||||||

| (2) | See Note 15 to our consolidated financial statements included elsewhere in this prospectus for an explanation of the calculations of our basic and diluted net loss per share attributable to common stockholders and the weighted-average number of shares used in the computation of the per share amounts. |

| (3) | Pro forma net loss per share gives effect to (a) the automatic conversion of all of our outstanding shares of convertible preferred stock into an aggregate of 306,300,407 shares of Class A common stock (after giving effect to the Series F Financing), (b) the net conversion of 17,606,860 RSUs into shares of Class A common stock for which the service-based vesting condition was satisfied on or before the date of the offering and for which the performance-based vesting condition will be satisfied in connection with this offering, after withholding an aggregate of 165,841 shares to satisfy associated estimated income tax obligations from certain tax jurisdictions (based on an assumed 45% tax withholding rate), and (c) stock-based compensation expenses of approximately $224.9 million related to RSUs for which the service-based vesting condition was satisfied and for which the performance-based vesting condition will be satisfied in connection with this offering. |

| (4) | We define ARR as annualized invoiced amounts per solution sku from subscription licenses and maintenance obligations assuming no increases or reductions in their subscriptions. ARR is not a calculation of revenue and does not include invoiced amounts reported as perpetual licenses or professional services revenue in our consolidated statements of operations. See the section titled Managements Discussion and Analysis of Financial Condition and Results of OperationsKey MetricAnnualized Renewal Run-Rate included elsewhere in this prospectus for additional information on our ARR metric. |

17

Table of Contents

| As of January 31, 2021 | ||||||||||||

| Actual | Pro Forma(1) |

Pro

Forma As Adjusted(2)(3)(4) |

||||||||||

| (in thousands) | ||||||||||||

| Consolidated Balance Sheet Data |

||||||||||||

| Cash, cash equivalents, restricted cash, and marketable securities |

$ | 474,018 | $ | 1,224,018 | $ | 1,692,115 | ||||||

| Total assets |

866,461 | 1,616,461 | 2,083,064 | |||||||||

| Working capital(5) |

369,274 | 1,110,484 | 1,579,342 | |||||||||

| Accrued expenses and other current liabilities |

36,660 | 45,450 | 44,689 | |||||||||

| Convertible preferred stock |

1,221,968 | | | |||||||||

| Total stockholders (deficit) equity |

(803,704 | ) | 1,159,474 | 1,626,838 | ||||||||

| (1) | The pro forma consolidated balance sheet data gives effect to (a) the automatic conversion of all of our outstanding shares of convertible preferred stock into an aggregate of 306,300,407 shares of Class A common stock (after giving effect to the Series F Financing), (b) the filing and effectiveness of our amended and restated certificate of incorporation immediately prior to the closing of this offering, (c) the net conversion of 17,606,860 RSUs into shares of Class A common stock for which the service-based vesting condition was satisfied on or before the date of the offering and for which the performance-based vesting condition will be satisfied in connection with this offering, after withholding an aggregate of 165,841 shares to satisfy associated estimated income tax obligations from certain tax jurisdictions (based on an assumed 45% tax withholding rate), (d) the related increase in accrued expenses and other current liabilities and a corresponding decrease in additional paid-in capital for the associated tax liabilities related to the net settlement of the RSUs; and (e) stock-based compensation expenses of approximately $224.9 million related to RSUs for which the service-based vesting condition was satisfied and for which the performance-based vesting condition will be satisfied in connection with this offering. |

| (2) | The pro forma as adjusted consolidated balance sheet data reflects (a) the pro forma adjustments set forth above, (b) our receipt of $467.4 million in net proceeds from the issuance and sale of 9,416,384 shares of Class A common stock that we are offering at an assumed initial public offering price of $53.00 per share, the midpoint of the estimated price range set forth on the cover page of this prospectus, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us, and (c) the conversion of 1,383,168 shares of Class B common stock into an equal number of shares of Class A common stock in connection with the sale of such shares by the selling stockholders in this offering. For more information, see the section titled Principal and Selling Stockholders. We will not receive any proceeds from the sale of shares of our Class A common stock by the selling stockholders. Accordingly, there is no impact on the pro forma as adjusted consolidated balance sheet for these shares. |

| (3) | A $1.00 increase (decrease) in the assumed initial public offering price of $53.00 per share, the midpoint of the estimated price range set forth on the cover page of this prospectus, would increase (decrease) each of our pro forma as adjusted cash, cash equivalents, restricted cash, and marketable securities, and total assets, working capital and total stockholders (deficit) equity by approximately $9.0 million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same, and after deducting the estimated underwriting discounts and commissions. Similarly, each increase (decrease) of 1,000,000 shares in the number of shares of Class A common stock offered by us would increase (decrease) each of our pro forma as adjusted cash, cash equivalents, restricted cash, and marketable securities, and total assets, working capital and total stockholders (deficit) equity by $50.4 million, assuming the assumed initial public offering price of $53.00 per share of Class A common stock remains the same, and after deducting the estimated underwriting discounts and commissions. |

| (4) | Pro forma as adjusted cash, cash equivalents, restricted cash, and marketable securities, and total assets do not give effect to $0.7 million of deferred offering costs that had been paid as of January 31, 2021. |

| (5) | Working capital is defined as current assets less current liabilities. |

18

Table of Contents

Investing in our Class A common stock involves a high degree of risk. You should consider and read carefully all of the risks and uncertainties described below, as well as other information included in this prospectus, including our consolidated financial statements and related notes appearing elsewhere in this prospectus, before making an investment decision. The risks described below are not the only ones we face. The occurrence of any of the following risks or additional risks and uncertainties not presently known to us or that we currently believe to be immaterial could materially and adversely affect our business, financial condition, or results of operations. In such case, the trading price of our Class A common stock could decline, and you may lose some or all of your original investment.

Risks Related to Our Business, Products, Operations, and Industry

Our recent rapid growth may not be indicative of our future growth. Our limited operating history and recent rapid growth also make it difficult to evaluate our future prospects and may increase the risk that we will not be successful.

Our annualized renewal run-rate, or ARR, was $351.4 million and $580.4 million in the fiscal years ended January 31, 2020 and 2021, respectively, representing a growth rate of 65%. We generated revenue of $336.2 million and $607.6 million for the fiscal years ended January 31, 2020 and 2021, respectively, representing a growth rate of 81%. You should not, however, rely on the ARR or revenue growth of any prior quarterly or annual fiscal period as an indication of our future performance. We were incorporated in June 2015, and as a result of our limited operating history, our ability to accurately forecast our future results of operations is limited and subject to a number of uncertainties, including our ability to plan for and model future growth. Even if our ARR and revenue continue to increase, we expect that our ARR and revenue growth rates will decline in the future as a result of a variety of factors, including the maturation of our business, increased competition, changes to technology, a decrease in the growth of our overall market, or our failure, for any reason, to continue to take advantage of growth opportunities. Overall growth of our business depends on a number of additional factors, including our ability to:

| | price our products effectively so that we are able to attract new customers and expand sales to our existing customers; |

| | expand the functionality and use cases for the products we offer on our platform; |

| | maintain and expand the rates at which customers purchase and renew licenses to our platform; |

| | provide our customers with support that meets their needs; |

| | continue to introduce and sell our products to new markets; |

| | continue to develop new products and new functionality for our platform and successfully further optimize our existing products and infrastructure; |

| | successfully identify and acquire or invest in businesses, products, or technologies that we believe could complement or expand our platform; and |

| | increase awareness of our brand on a global basis and successfully compete with other companies. |

We may not successfully accomplish any of these objectives, and as a result, it is difficult for us to forecast our future results of operations. If the assumptions that we use to plan our business are incorrect or change in reaction to changes in our market, or if we are unable to maintain consistent ARR, revenue, or ARR or revenue

19

Table of Contents

growth, our stock price could be volatile, and it may be difficult to achieve and maintain profitability. You should not rely on our ARR or revenue for any prior quarterly or annual fiscal periods as an indication of our future ARR or revenue or ARR or revenue growth.

In addition, we expect to continue to expend substantial financial and other resources on:

| | our technology infrastructure, including systems architecture, scalability, availability, performance, and security; |